BetterCar Value Insurance

Cash Back

Simply add the Cash Back Bonus to your Budget Insurance policy and if you remain claim free for two years, we’ll reward you by giving you money back.

BetterCar Value Benefits

Same Car Model

Get the same car but one year newer with fewer kms on the clock if your car is written off.

Assist Benefits

Use our Road, Home, Medical, Trauma, Legal, and Entertainment Assist whenever you need help to get out of a sticky situation.

Budget Insurance Towline

The cost of towing and storing your car after an accident is on us – just call the Budget Insurance towline

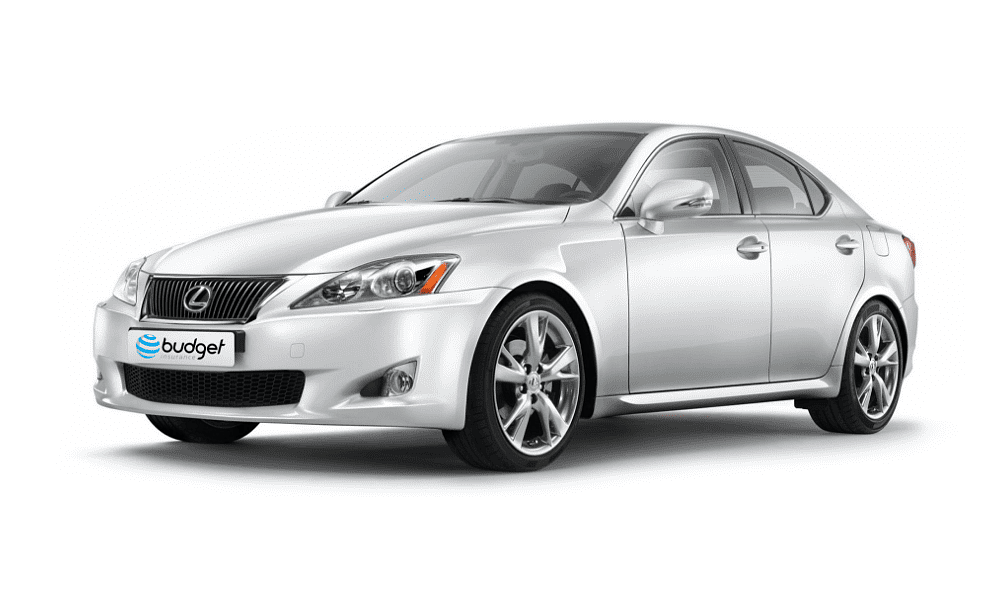

What Is BetterCar Value Insurance?

With BetterCar Value Insurance, you enjoy all the same excellent cover and benefits you would with our Comprehensive Car Insurance. This includes cover against theft, hijacking, loss, accidental damage, and third-party damages. However, you also get one additional benefit – insurance for the BetterCar value of your car.

Traditionally, you would insure your car for its retail, market, or trade value. Which you choose affects your payout amount, with the retail value being the highest and trade being the lowest.

At Budget, you have a fourth option. You can insure your car for its BetterCar value. This is a minimum of 15% more than the retail value. That means, if your car is written off, you can get the same model car but one year newer – and with less mileage.

What are the BetterCar Value Insurance benefits?

You get to use our range of Assist Benefits any time you’re in a dodgy situation on the road or need some help at home.

-

Road Assist: We’re there to help if you lock your keys in your car, run out of fuel, or get a flat tyre.

-

Home Assist: Our database of professional electricians, plumbers, locksmiths, and more will help you out with home emergencies.

-

Medical Assist: Get access to trained medical professionals if you have a medical emergency.

-

Trauma Assist: If you ever face a traumatic situation, you can get the counselling you need with our Trauma Assist benefit.

-

Legal Assist: We offer you access to telephonic legal help and assistance with your tax matters.

-

Entertainment Assist: Get all the deets on everything that’s happening in your area and book events with our Entertainment Assist.

More about car insurance

We use a calculator to give you a quote that’s within budget. Find out how it works.

How much do you really know about your insurance companies in South Africa? At Budget Insurance, we want you to be informed.

We offer seven different insurance types. Choose from our most comprehensive plan right down to the lightest cover for the tightest budgets with Budget Lite.

Absolutely amazing service! Thank you to Eugene who helped the morning of the accident. Our claim was handled in record time, and you phoned exactly when you said you would. Thank you Budget. All your people are gems.

Annelize Faca

Just in case you're not convinced

Other Car Insurance Products

Get every kind of cover you’d need when you’re driving on our roads – theft, loss, accidental damage, and third-party damage.

Not quite as inclusive as Comprehensive Cover, Third-Party, Fire & Theft still covers you for most scenarios, just not accidental damage to your car.

Our most basic plan, Third-Party Only protects your legal and financial interests if you cause an accident and damage someone’s property.

Lekker and light, Budget Lite is for small budgets that need more than just Third-Party Only Car Insurance. Check out our three affordable plans.

Repairing light scratches, dents, and chips can get expensive, but not when you have Scratch & Dent Cover with Budget.

With all the road hazards that can damage or ruin your car’s tyres and rims, it just makes sense to take out Tyre & Rim Guard.

In addition to having BetterCar Insurance, you can also avoid a financial shortfall on your car finance when you have our Auto Top-Up product.

You obviously love your car. Keep it in good running condition with a Budget Motor Warranty. This helps you pay for any electrical or mechanical faults that might arise.