Third-Party, Fire & Theft Car Insurance

Get a Third party, fire & theft car insurance quote in minutes

4.5 /5

Cash Back

Simply add the Cash Back Bonus to your Budget Insurance policy and if you remain claim free for two years, we’ll reward you by giving you money back.

Third-Party, Fire & Theft Car Insurance Benefits

Add Ons

Add your sound system, canopy, and windscreen to your policy to boost your cover.

Cover for Damage

You get cover for damage caused not only by fire but by an explosion or lightning too.

Increase your Cover

Increase your third-party cover to suit your needs.

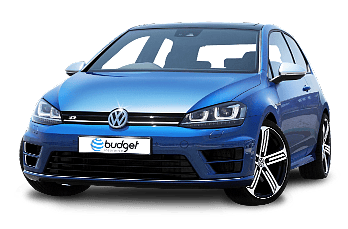

What is Third-Party, Fire & Theft Car Insurance?

Third-Party, Fire & Theft Cover is our mid-range option between Comprehensive and Third-Party Only. Even though the name says it all, let’s take a look in detail what you’re covered for when you take out this type of insurance.

Third-Party Cover

When two or more cars are involved in an accident, most of the time one of the drivers is at fault. If that happens to be you, the other driver(s) can hold you legally liable for the damage you cause to their car, and any of their belongings. Depending on the severity of the accident, you might be ordered to pay up to millions in damages to the other drivers.

Because almost no one has that kind of money lying around, we offer third-party cover. Up to a specified limit, we will cover the damage to repair the other person’s property, as well as any damages awarded against you in a legal case.

Fire Cover

Fire might seem like quite a specific risk to insure against, but there are many ways this peril can affect your car.

Whether your car itself ignites, you have a fire in the home that spreads to your vehicle, or a blaze in the veld spreads to your property, we will cover the cost of repairing or replacing your car if it’s damaged by fire.

Theft Cover

In South Africa, vehicle theft cover is a must-have. Without insurance, if your car is stolen, you’ll have to keep paying it off even though it’s in the hands of a criminal. We will pay you out for your car so you can pay off what you still owe on it and possibly even put a deposit down on a new car. Get a car insurance quote online with us today!

More about car insurance

We use a calculator to give you a quote that’s within budget. Find out how it works.

How much do you really know about your insurance companies in South Africa? At Budget Insurance, we want you to be informed.

We offer seven different insurance types. Choose from our most comprehensive plan right down to the lightest cover for the tightest budgets with Budget Lite.

Absolutely amazing service! Thank you to Eugene who helped the morning of the accident. Our claim was handled in record time, and you phoned exactly when you said you would. Thank you Budget. All your people are gems.

Annelize Faca

Frequently asked questions

Other Car Insurance Products

This plan is one step below Third-Party, Fire & Theft. It’s plain and simple third-party liability cover. So if you cause an accident, you have the means to cover the third-party damages.

If there is a shortfall between your insurance payout and what you still owe on your stolen or written-off vehicle, we’ll cover it.

Keep your car looking shiny and new with our Scratch & Dent policy. It pays to fix up minor scratches, chips, and dents on your car’s body.

Remember when we mentioned our best Car Insurance product back there? Well, this one’s even better. We’ll payout for a newer version of the car you already have.

This is our best Car Insurance product. It includes everything you need for peace of mind on the road – cover against theft, loss, accident, and third-party claims.

We offer three Budget Lite plans, ideal for the tightest budgets. Get cover for third-party liability and depending on the plan, hail damage and theft.

No matter how careful you are on the road, potholes have a habit of appearing out of nowhere. When this happens, you can repair your damaged tyres and rims.

Get affordable cover for the mechanical and electrical faults that are bound to pop up sometime in your car.