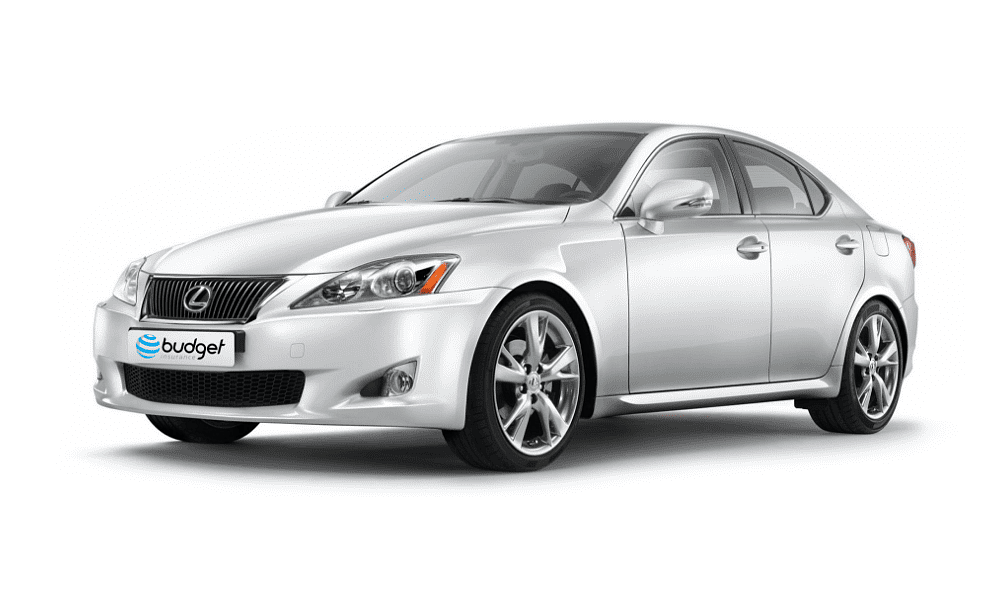

Comprehensive vehicle cover at its best

Get a Comprehensive car insurance quote in minutes

4.5 /5

Cash Back

Simply add the Cash Back Bonus to your Budget Insurance policy and if you remain claim free for two years, we’ll reward you by giving you money back.

Comprehensive Car Insurance Benefits

We’ve got helpful Assist Benefits for just about everything you might need – Accident and Breakdown Assist plus, Home, Medical, and even Legal Assist.

Towing and Storage

As part of our Accident Assist benefit, we’ll tow and store your car for you if you’ve been in an accident and the car can’t be driven.

Include a Cash Back Bonus and you only have to wait two claim-free years to get 15% of your premiums back.

What Is Comprehensive Car Insurance?

Comprehensive Car Insurance is everything you’ve been looking for from an insurance partner. It’s the full package. It covers more risks than any other type of auto insurance. This includes theft and hijacking, loss, accidental damage, and third-party damage.

And when you have cover with Budget, it’s also affordable, ‘cos we know you can’t afford not to have it. Here’s more detail on what our Comprehensive plan covers:

Theft, hijacking, and loss

Of course our Comprehensive Car Insurance in South Africa includes theft and hijacking cover. We know you can’t afford to have your car stolen or damaged in a hijacking – then where would you be? How would you get around? That’s why if your car is stolen and not recovered, we’ll pay you out for the amount stated in your schedule – usually the retail, market or trade value.

Accident Cover

You only take your eyes off the road for a second when you’re changing songs in the car, but that’s all it takes. If you have an accident, whether it’s your fault or someone else’s, we’ll pay to repair or replace the parts of your car that are damaged.

If your car isn’t driveable, we’ll also pay for a tow truck to take it to the panel beater and cover the costs of storage too. ‘Cos we’re nice like that.

Third-party cover

If you damage someone else’s car in an accident that is your fault, did you know you can be legally responsible for paying to repair the damage? Third-party cover protects you when this happens by covering the costs of the repairs up to the limit in your schedule.

More about car insurance

We use a calculator to give you a quote that’s within budget. Find out how it works.

How much do you really know about your insurance companies in South Africa? At Budget Insurance, we want you to be informed.

We offer seven different insurance types. Choose from our most comprehensive plan right down to the lightest cover for the tightest budgets with Budget Lite.

Absolutely amazing service! Thank you to Eugene who helped the morning of the accident. Our claim was handled in record time, and you phoned exactly when you said you would. Thank you Budget. All your people are gems.

Annelize Faca

A comprehensive list of anwers

Other Car Insurance Products

Just as the name suggests, you can get an even better car than the one you currently drive if yours is written off.

Make sure you are covered financially if you damage someone else’s property. Plus, cover your car if it’s damaged by fire or stolen.

It can be expensive to repair someone else’s car if you cause an accident. We’ll help you pay for it with Third-Party Only Car Insurance.

With three Budget Lite options to choose from, there’s a lekker car insurance plan that was just made for your smaller budget.

Scratches, dents, and chips seem to magically appear out of nowhere. Make them disappear again with a Scratch & Dent policy.

If your tyres or rims are damaged by badly maintained roads, you can use our Tyre & Rim Guard to repair or replace them.

Auto Top-Up covers the shortfall you might have between your Car Insurance payout and what you still owe on your car.

When your car acts up and things go wrong with the mechanics or electrics, our Motor Warranty will help pay for the repairs.